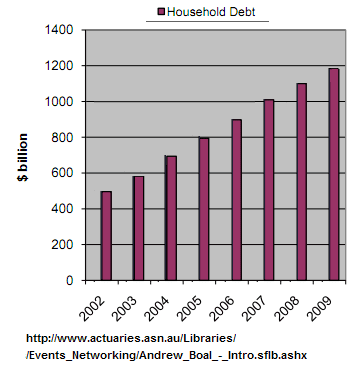

Personal, Household or Consumer Debt including mortgages.

- Australian Personal debt = $54,545 per person (A$1,200bn / 22m) (Sources 3 & 4)

- UK Personal debt = £23,560 per person (£1,456bn / 61.8m) (Sources 1 & 2)

- USA Personal debt = US$55,386 per person as at 2008 (Sources 5, 6 & 7)

More Country details to be added as found… Personal Debt excluding Mortgages

- Australian Personal debt = $6,136 per person (A$135bn / 22m) (Sources 3 & 4)

- UK Personal debt = £3,511 per person (£217bn / 61.8m) (Sources 1 & 2)

- USA Personal debt = US$7,854 per person ($2,418.9bn / 308m) (Sources 5 & 6)

These figures are the national totals divided by population. The most common forms of consumer debt are Mortgages, Vehicle Loans, Household Item Loans and Credit card debts, although some quoted figures of consumer debt exclude mortgages, which is why I have tried to show both figures in the examples above. Some of this debt is that they call Good debt, borrowing to buy investments, but some is not good debt in that sense, as there is no intrinsic return on the item purchased. Unfortunately the average figures released, do not, as far as I can find, show the difference in the good debt and the not good debt. Consequently, the average figures can be very distorted.

Two personal debt examples:

ONE

Mortgage $500,000 Income $25,000

Looks bad, but if they own $1,000,000 in property, and a $1,0000,000 in shares, it can appear very different. But they still show up as someone in debt to the tune of 20x their annual income.

Compared to TWO

Mortgage $500,000 Income $100,000

But maybe they only own $50,000 or 10% of the value of the property. But they are only in debt to the tune of 5x their annual income.

So… much healthier than the first example, in theory…

These two extreme examples show how personal debt figures can be very misleading.

- Example one has NET ASSETS after debt, of $1,500,000 but has a debt level 20x income.

- Example two has a NET DEBT of $450,000 yet ONLY has a debt level of 5x income.

More reading…

- 2008 UK – Debt-Gorged British Start to Worry That the Party Is Ending www.nytimes.com/2008/03/22/business/worldbusiness/22debt.html

- 2009 Australia – Household debt tops national income for first time www.news.com.au/money/money-matters/household-debt-tops-national-income-for-first-time

- Australia – Credit binge sets new debt record www.dailytelegraph.com.au/news/sunday-telegraph/credit-binge-sets-new-debt-record/story

Sources:

- Total UK personal debt at the end of July 2010 stood at £1,456bn http://www.creditaction.org.uk/debt-statistics.html

- UK Population 61.8million. http://www.guardian.co.uk/…/uk-population-reaches-nearly-62m

- Reserve Bank figures show mortgage, credit card and personal loan debts now stand at $1.2 trillion. Equalling $56,000 for every man, woman and child in the country. Mortgages account for almost 90% and the remaining 11% is $45 billion on credit cards and over $90 billion on personal loans, car finance and other personal debts.http://www.news.com.au/…/household-debt

- Australian Population 22 million. http://www.abs.gov.au

- USA Consumer debt 2,418.9bn http://www.federalreserve.gov

- USA Population 308m. http://www.census.gov

- USA Mortgage debt $14,640bn as at 2008. http://www.census.gov Table 1155

Source 3: RBA total debt figures show $1,099.1 billion for personal lending at table d5.

More Reading: www.rba.gov.au/speeches/2010/sp-dg-150610.html

4,275.1 - 958,996